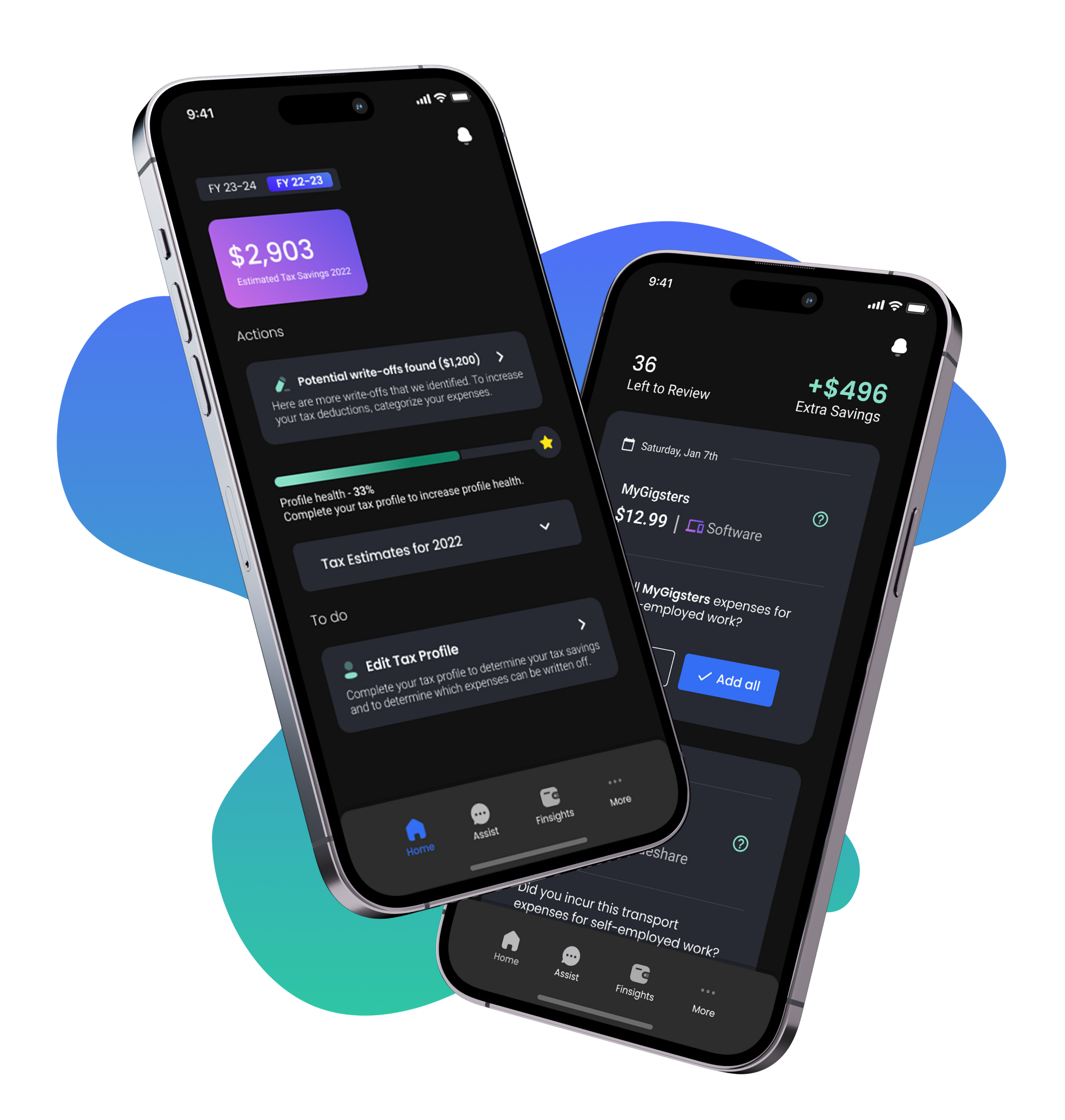

Our new smart tax buddy can automatically track your income and expenses to personalise your bookkeeping experience. Uncover hidden tax deductions in minutes and lodge your taxes right from the app!

Connect your bank account with the app to personalise your tax lodging experience in minutes!

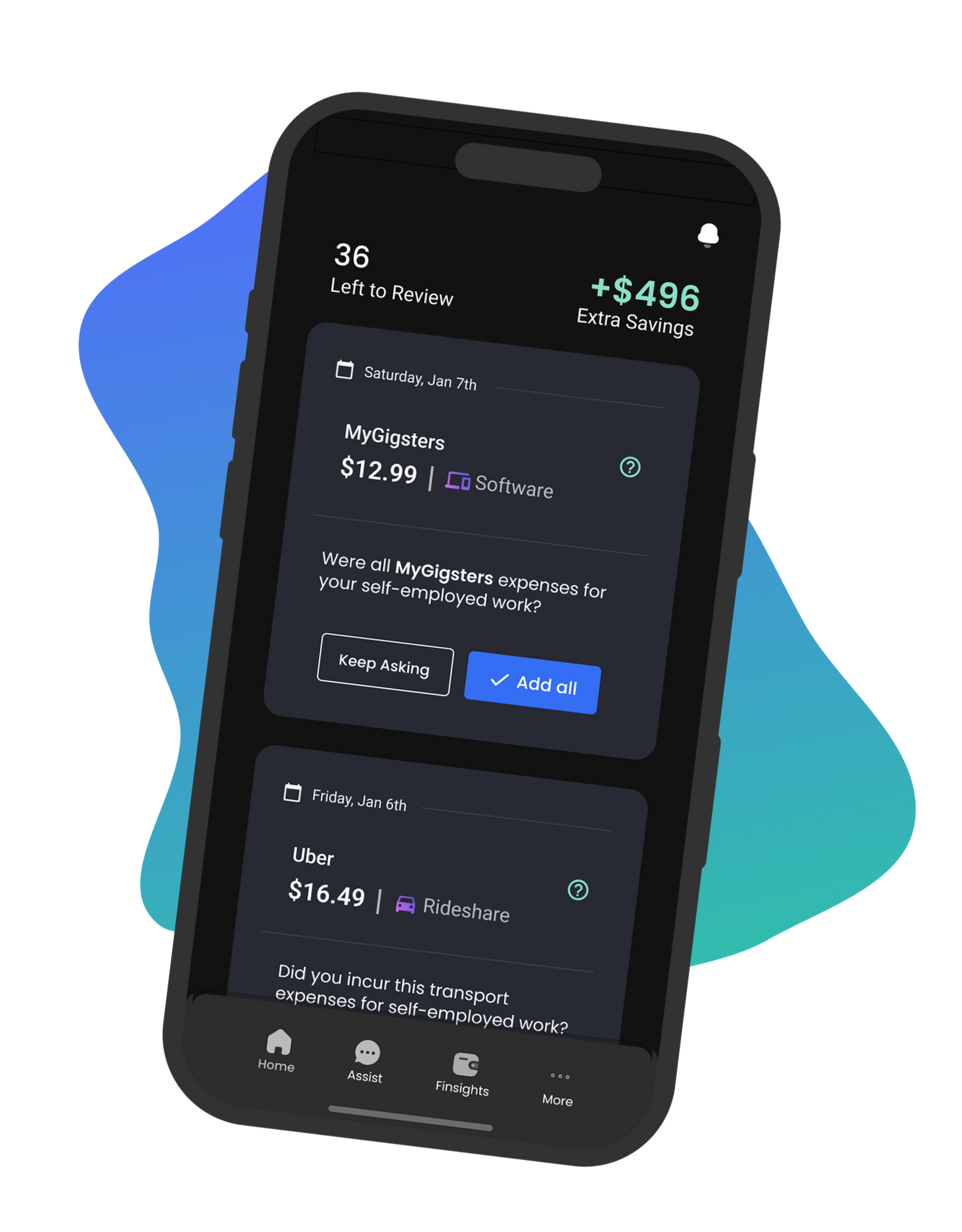

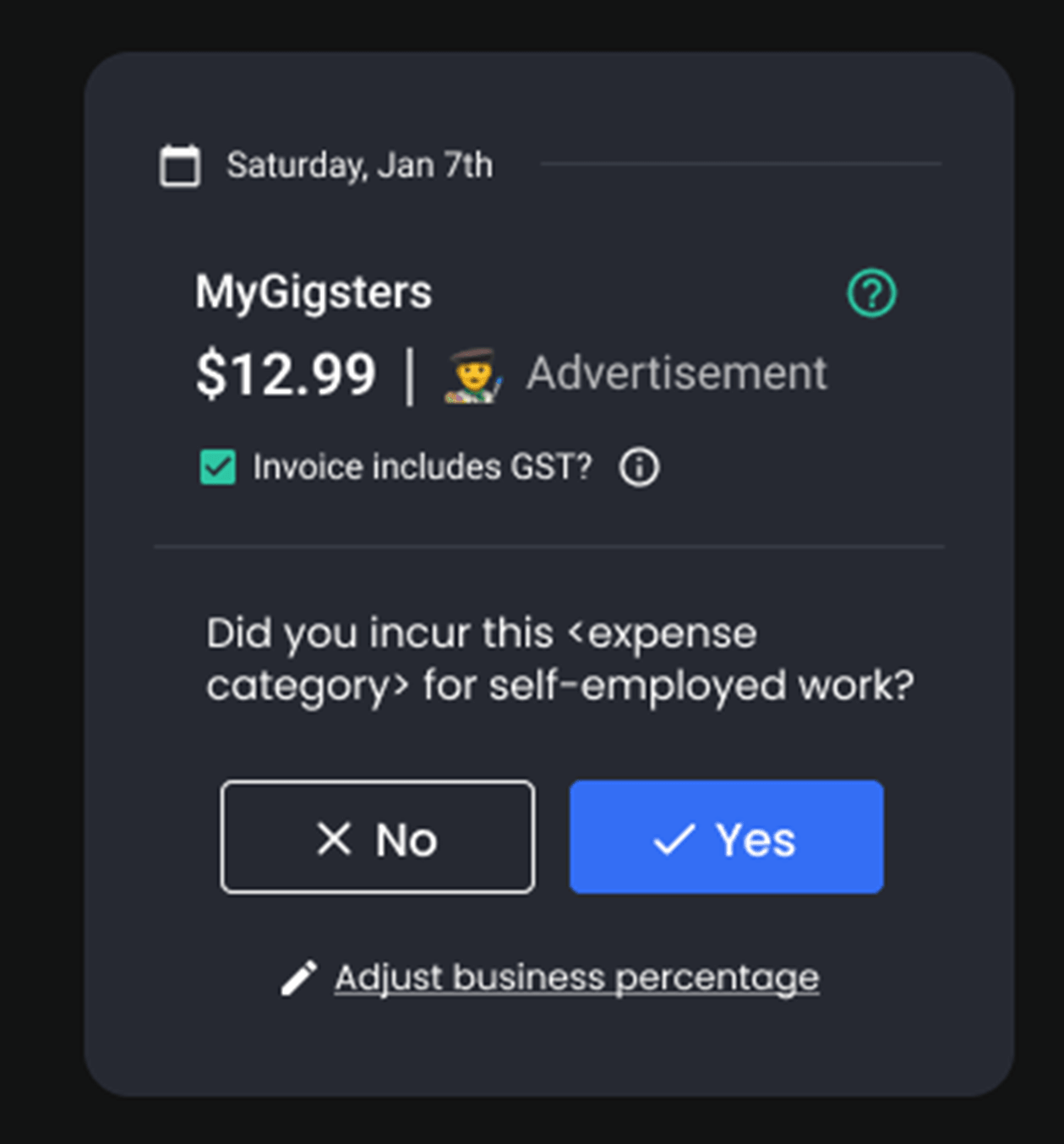

Our AI algorithm analyses your transaction history to discover potential tax deductible business expenses to make sure that you make the most of your tax returns!

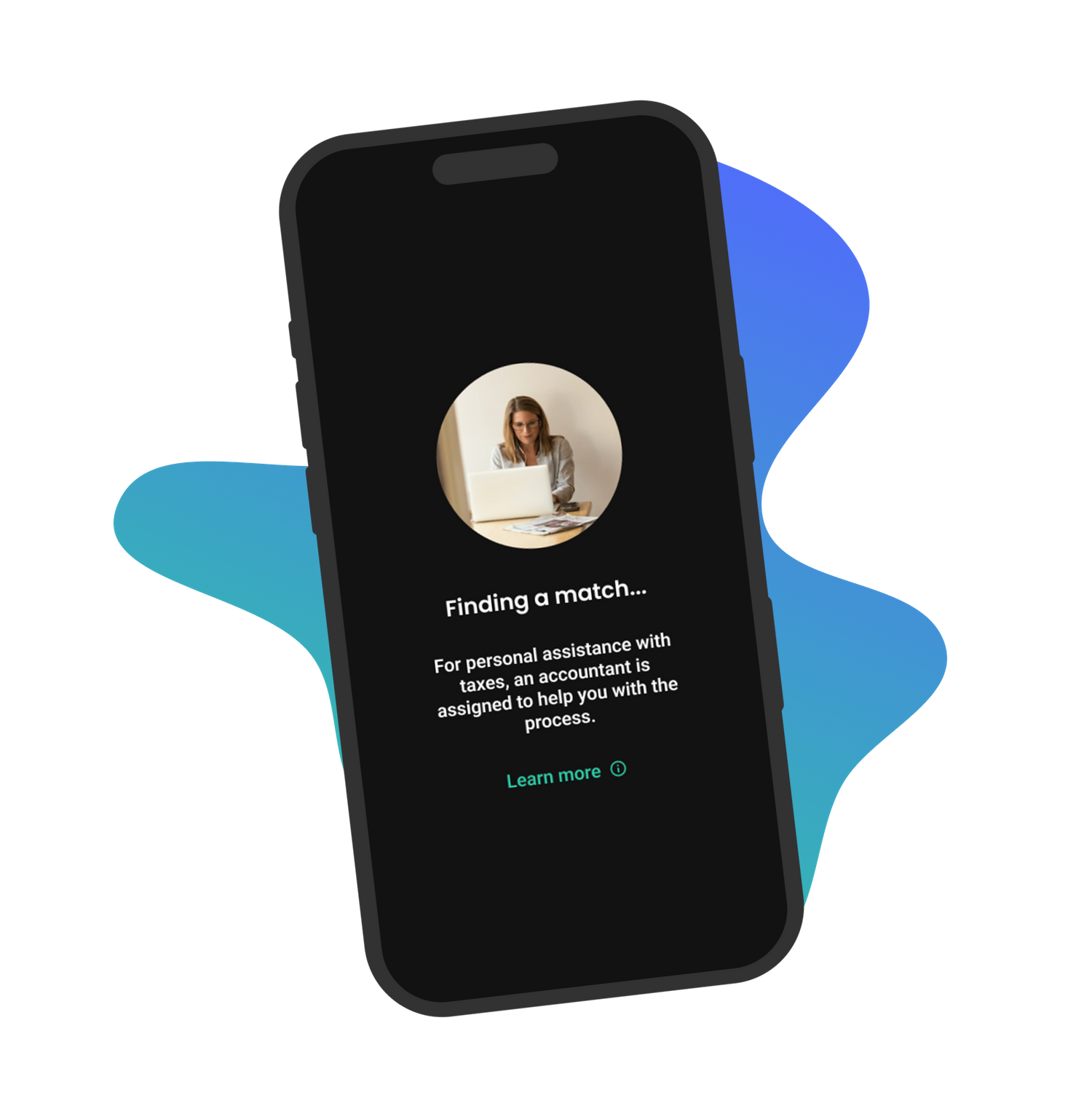

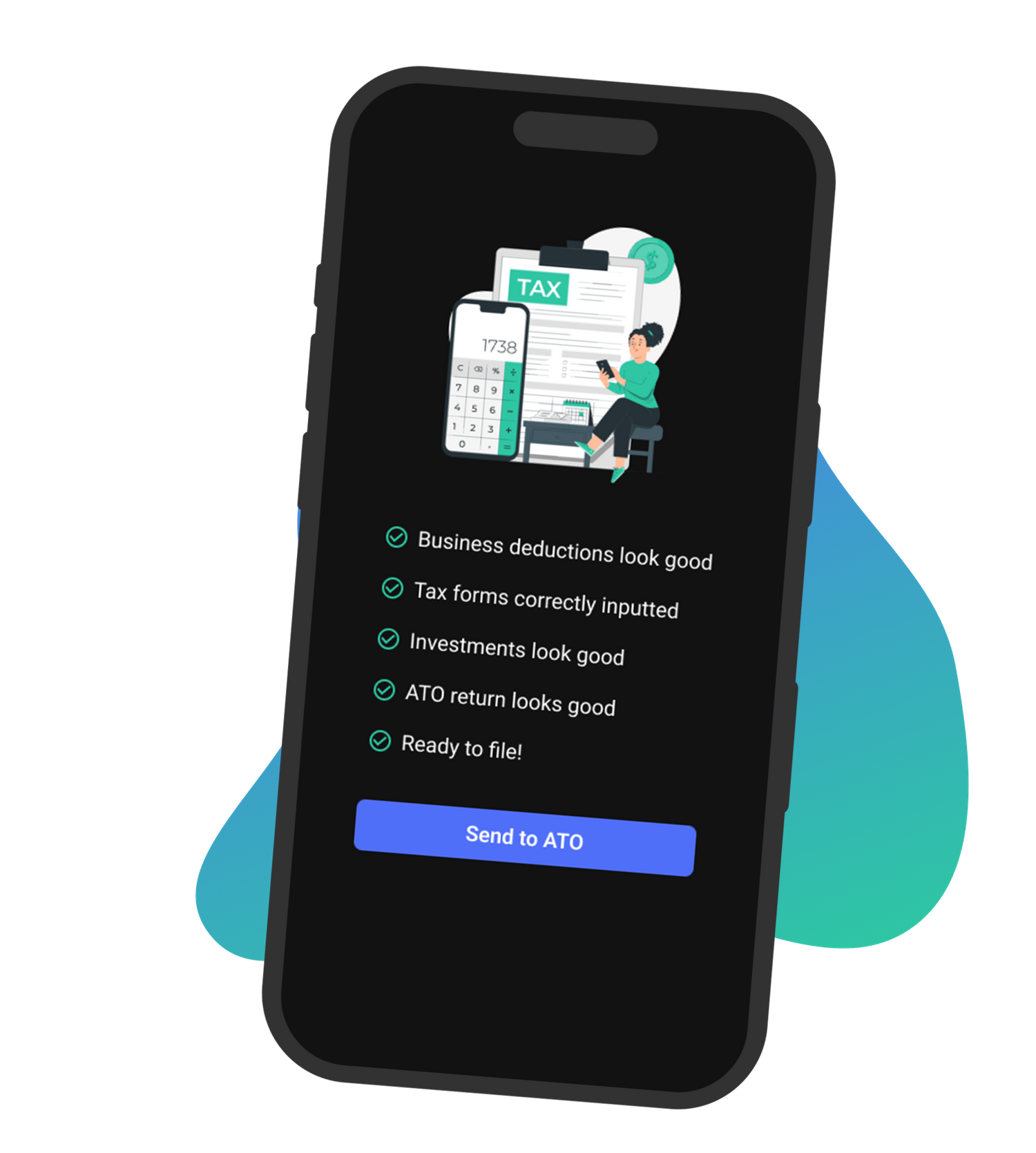

We have made sure that all of the reports and financial statements are reviewed by an expert before lodging. You will be assigned a dedicated registered accountant to help you navigate through finances and lodgements.

When you file your taxes with us, expect professional results. Our registered Tax agents will review, verify and prepare your ATO lodgements.

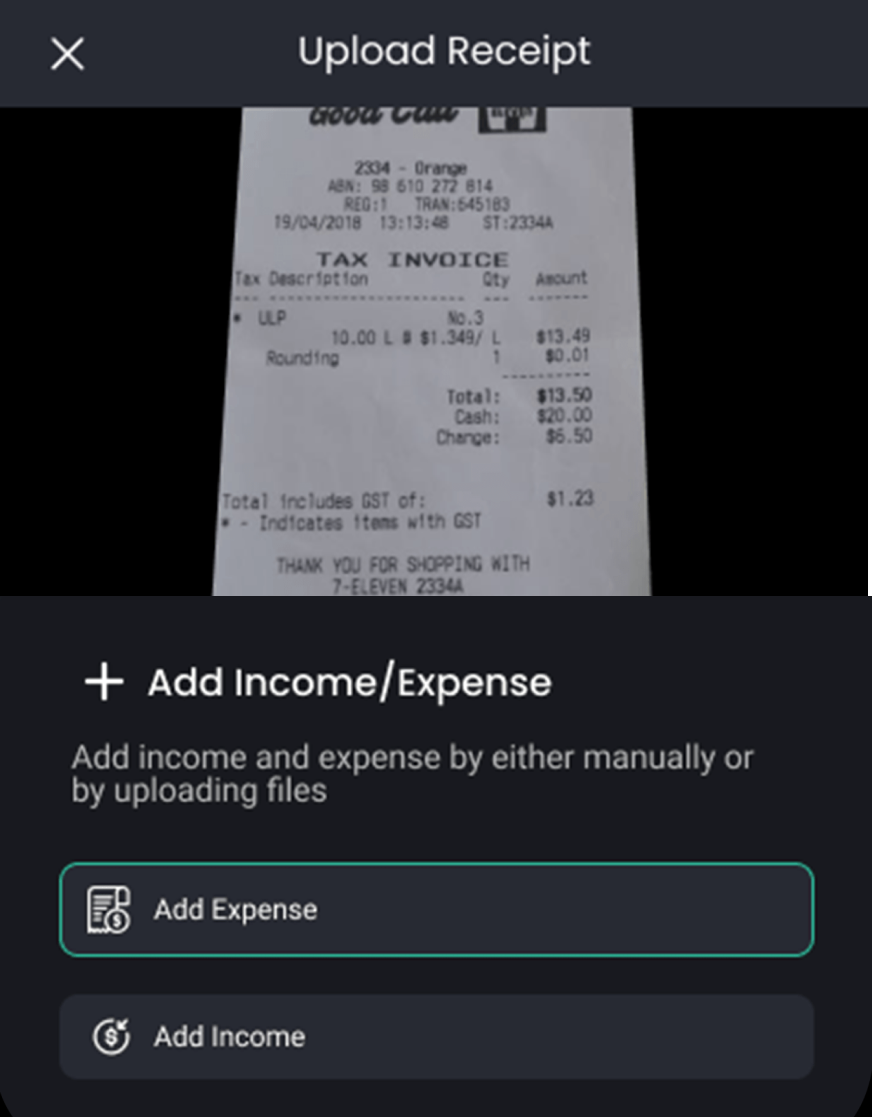

Manually track your expenses with smart snap & store receipts. No need to carry the shoe box of receipts anymore.

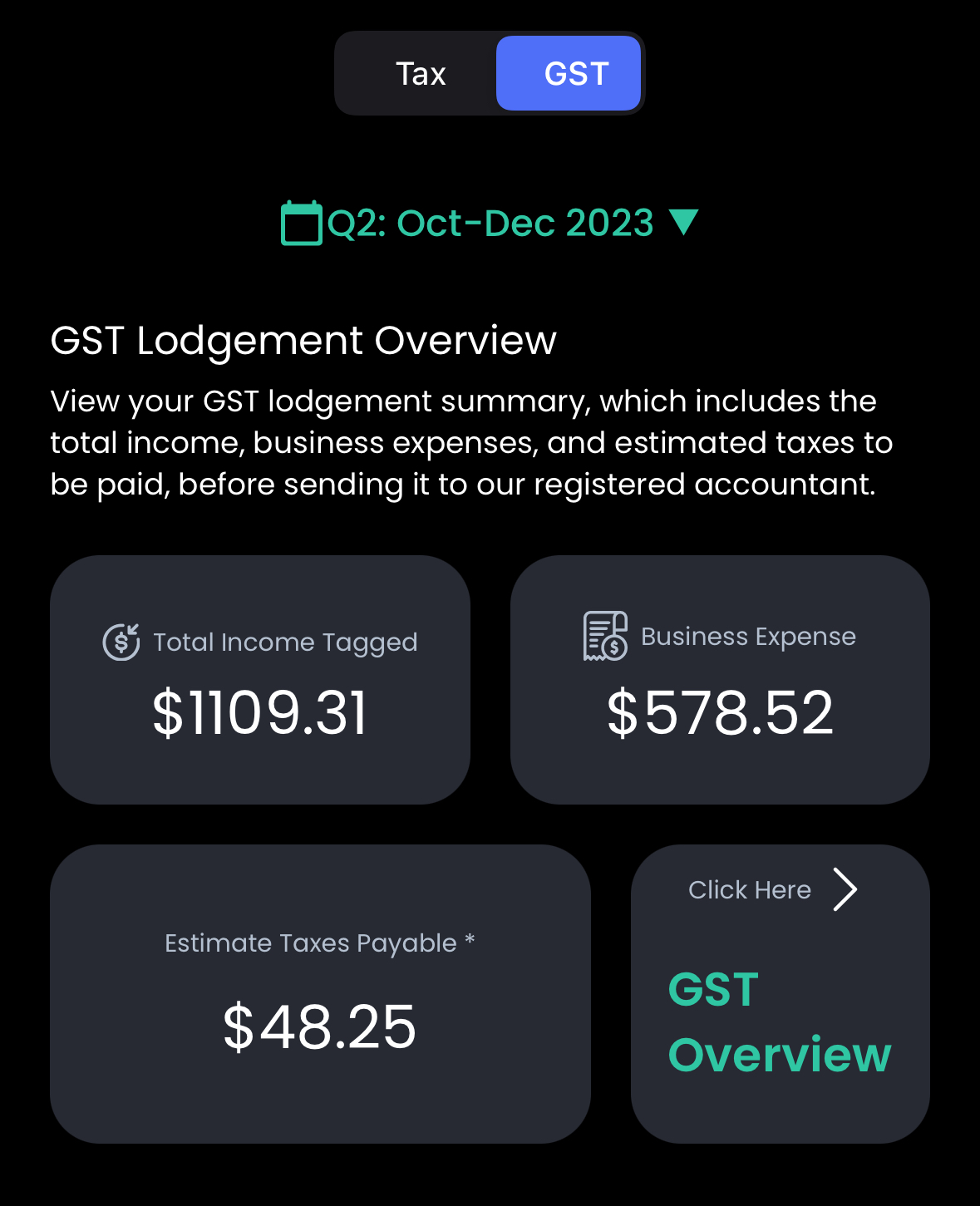

With a tap of a button, you can get a quick view on your estimated tax and GST position. This will help you plan things and work with us proactively to maximise your returns.

The algorithm captured all your income and expenses personalised your work profile. You have full control on the data.

We are a small accounting firm in West Perth that provides accounting and tax services to individuals and small businesses. Our team of accountants are highly skilled and experienced and can assist clients in setting up a business or dealing with the tax office. Our company mission is to provide accounting- and tax services of the highest standards, to always act professional and with integrity and to deliver value to our clients that earns their respect and loyalty. TaxSense, we help you make sense of your tax.

By completing this form, you provide the permission for the accounting firm to contact you (via email or phone) to talk about your reqiurement and assit as required.

We have partnered with MyGigsters, an award winning technology platform to offer automated solutions to individuals like you.

Our platform uses artificial intelligence to scan your bank transactions and automatically categorise your expenses for tax purposes. You can also manually add expenses or upload receipts for our system to process. We aim to save you time and effort by automating the expense tracking process.

Yes, we take data security very seriously. We use industry-leading encryption and protection measures to ensure that your data is stored securely on our platform.

All the data is stored in Australia and shared with any third party only for the purpose of filing tax returns and your explicit consent

Yes! From bookkeeping to filing taxes, our registered accountants will help you file your taxes.

Absolutely! We are always up for a chat. Ping us on the chat or email us at hello@mygigsters.com.au

100% Yes, The app is packed with features - Auto-mileage log book, indepth analytics on your income, expense, tax estimate and access to curated offers from our partners.

When we onboard you to the app, we will ask you relevant questions about your gig that will help us create your tax profile. The tax profile will inform the AI on which expenses are eligible for tax deductions.

We respectfully acknowledge the Traditional Owners of the land on which we work, and pay respect to the First Nations Peoples and their elders, past, present and future.

© Copyright 2024 Ideal Business Solutions